TrueCar.com

TrueCar.com is a website that aggregates pricing data for new car purchases allowing you to see what others paid for the vehicle you are considering. Although TrueCar.com focuses on new car purchases, we can use this data to get the lowest possible payment when we lease a vehicle. Knowing what other people have paid for the vehicle will help you feel confident that you are getting a fair price. But before we look at a specific example, let’s talk about the individual elements that make up a lease:

MSRP – The Manufacturers Suggested Retail Price is the starting point for leasing and is not negotiable.

Cap Cost – Cap Cost is shorthand for Capitalized Costs and is basically the amount you will be paying for the vehicle and is the equivalent to the purchase price when you buy a car. The key to getting a good lease deal is understanding that you can (and should!) negotiate the Cap Cost when you lease a vehicle. This is where the True Car pricing data is valuable and can help us during lease negotiations at the dealership. We’ll use the average price people have paid when buying a car as our Cap Cost when we plug the numbers into the Lease Calculator.

Residual Value – The amount the vehicle is expected to be worth at the end of the lease.

This is a projected value set by the financing company and is generally not negotiable.

Residual Percent – The percentage of the MSRP that is the Residual Value. Sometimes

the Residual Value is expressed as a percentage rather than a dollar amount.

The dealership should be willing to give you either the Residual Value or the Residual Percentage

while you are negotiating your lease. If they won’t do it I would suggest finding another dealership

to lease your vehicle. There is no need to waste time with people who are making the process more difficult

than it should be.

An alternate method for determining the Residual Percentage is to use these ball park values:

- 2 year lease - 60%

- 3 year lease - 50%

- 4 year lease - 45%

- 5 year lease - 40%

This method is only good if you are trying to get a general idea of the monthly payments before starting your lease negotiations, or getting a feel for the Lease Calculator and how it works. But I would not recommend this method during lease negotiations. As I said, the dealership has this value and they should provide it to you when you ask.

Term – The length of the lease in months.

Interest Rate – The cost of borrowing the money for the lease.

Money Factor – The Money Factor is just another way to

represent the Interest Rate when calculating monthly lease payments.

When you get to the Dealership and begin negotiating, you should ask for the specific Interest Rate

they are giving you for the lease deal. If they won't give the Interest Rate ask for the Money Factor.

I don't think they are required to provide this information, but if they don't you are not required to

lease the car from them...find another Dealership who will work with you.

If you don't know the Interest Rate /Money Factor at this point, you can go to the

Bankrate.com Auto Loan Rate search tool.

And like we did with the Residual Value/Residual Percentage, we are just trying to find a ballpark number

for the current Interest Rates being offered for Auto Loans.

Bankrate.com

lists Interest Rates for new and used

vehicles so we need to use the new vehicle rate for the length of the lease you are looking at.

Tax Rate – The tax rate that will be applied to the monthly lease payment.

So now that we have an understanding of the values that make up a lease calculation, let’s work through an example to see how to get those values from TrueCar.com and plug them into the Lease Calculator.

For the example, we’ll work on a lease for a Toyota Camry. First we'll navigate to the

TrueCar.com Select a Vehicle Page. and we'll select the correct

Make (Toyota) and Model (Camry), enter your zip code, and then click the Next button.

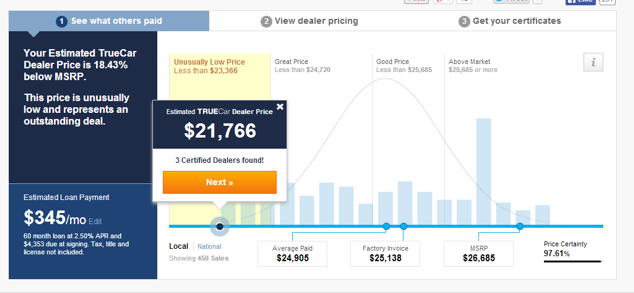

We are then shown the page below which contains the MSRP and Cap Cost. Again, the Cap Cost is the equivalent

of the Sale Price when you are buying a car, so negotiate this value as low as possible. In our case, we

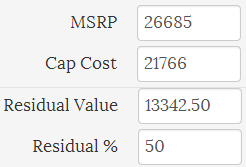

are going to use the MSRP of $26,685 and a Cap Cost of $21,766 since that is the Estimate True Car Dealer Price.

Next we will need a projected percentage for our calculation. For this example we will use a Residual Percentage

of 50% on a 3 year lease.

The calculator looks like this after entering the MSRP, Cap Cost and Residual Percentage:

The Residual Value was calculated when I added the Residual Percentage. And if you enter the Residual Value

the Residual Percentage will be calculated.

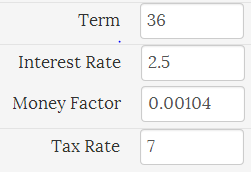

Using Bankrate.com

I’ve determined we should use an Interest Rate of 2.5% and we’ll use a Tax Rate of 7%.

The Money Factor was calculated when I entered the Interest Rate and the Interest Rate would be calculated

if I enter the Money Factor.

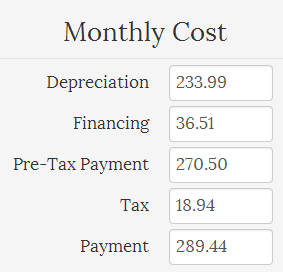

At this point in the example we have entered all the necessary values and the results shown below are displayed when we hit the "Calculate" button.

Now that we’ve worked through one example, you should play with the Lease Calculator to determine how different values affect the final monthly payment, which will help you when you are at the dealership negotiating your lease.

You now have all the ammunition you need to get yourself the best possible lease payment if you follow these basic steps:

- Perform Research on the vehicle(s) you want to purchase at TrueCar.com

- Get familiar with the Lease Calculator buy plugging in all the numbers for a specific vehicle

- Add MSRP and Cap Cost from TrueCar.com

- Add Residual Value/Residual Percent from dealership (or use the “ballpark” figures during your research before heading to the dealership)

- Add length of the lease

- Add Interest Rate/Money Factor from the dealership (or bankrate.com during your research phase)

- Add Tax Rate

- Click “Calculate” button to view results

- Head to the dealership to negotiate a great lease deal when you are comfortable with the Lease Calculator and have selected the vehicle of your choice

- Enjoy your vehicle!